WOTC.com

About WOTC.com

WOTC.com stands as a powerhouse in the financial services realm, offering unparalleled expertise in optimizing government incentives and tax credits to supercharge businesses’ profitability. With a leadership team boasting a cumulative 100 years of credit mastery and cutting-edge custom technology at their disposal, WOTC.com has successfully secured over $1 billion in government incentives for clients. Armed with a squad of credit virtuosos, WOTC.com specializes in navigating federal and state incentive credits such as the Work Opportunity Tax Credit, Research and Development Tax Credit, and a myriad of other lucrative opportunities.

Features & Benefits

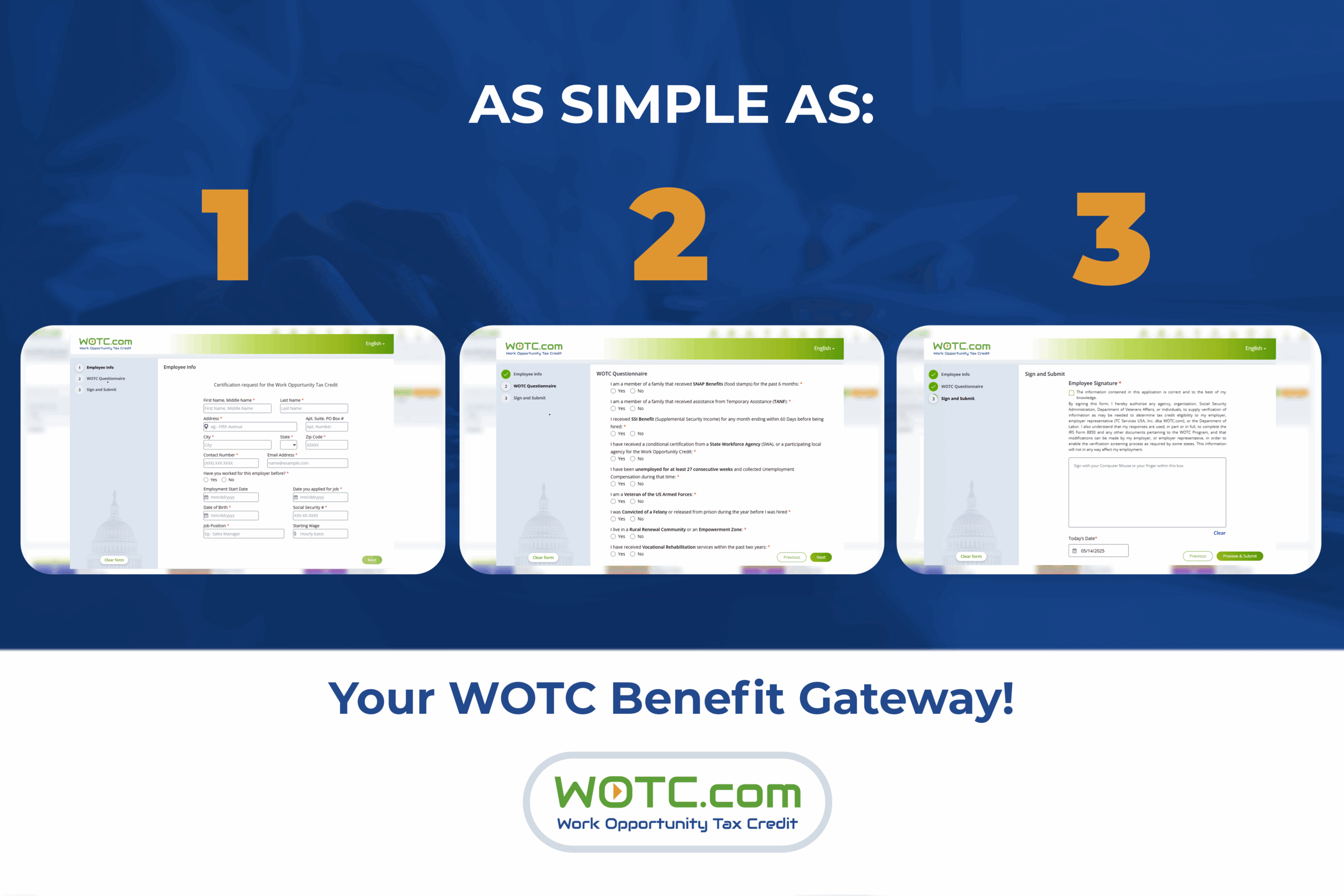

Seamless Automation for Stress-Free Compliance

Unlock Hidden Tax Credits! WOTC.com streamlines the process of claiming the Work Opportunity Tax Credit (WOTC), saving your business thousands on new hires.

Automated Eligibility Screening:

Instantly identifies eligible hires based on IRS criteria, reducing manual effort and errors.

Streamlined Submissions:

Simplifies the process by automating the submission of WOTC forms directly to the appropriate authorities.

Real-Time Tracking:

Provides status updates on submissions and approvals, keeping you informed every step of the way.

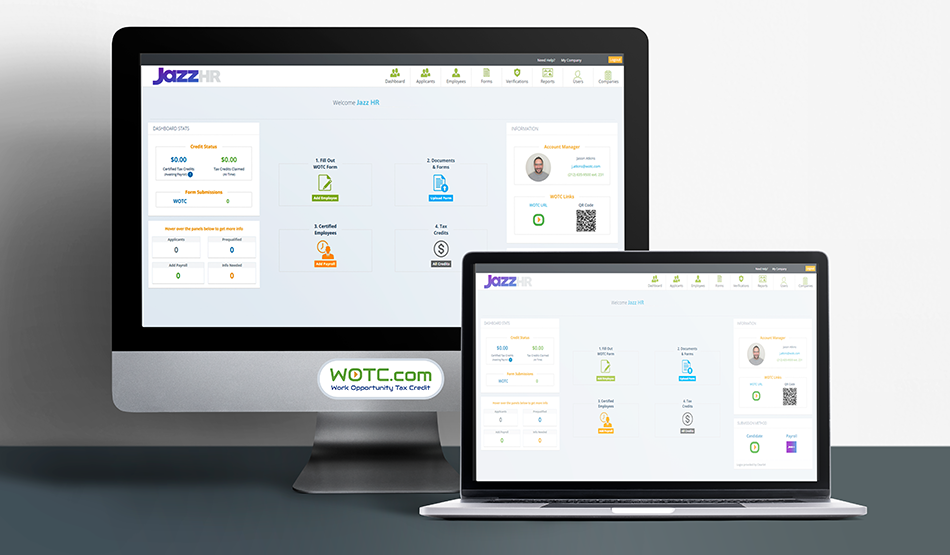

Seamless Payroll Integration:

Integrates effortlessly with JazzHR to ensure smooth data flow and minimize disruptions.

Maximized Tax Credit Opportunities:

Helps uncover every potential tax credit opportunity, even for employees with complex hiring circumstances.

Compliance Assurance:

Ensures all submissions meet federal and state requirements, reducing the risk of audits or penalties.

User-Friendly Dashboard:

Easy-to-use interface that gives you quick access to key insights and reports on tax credit performance.

Dedicated Support:

Access to expert support for any questions or issues related to WOTC claims, ensuring a smooth process from start to finish.

Increase Revenue Generated Through Tax Credit Savings

Boost Your Bottom Line with Tax Credit Savings! WOTC.com helps you maximize your tax savings by identifying and claiming eligible Work Opportunity Tax Credits. By reducing your tax burden, you can reinvest these savings in your business, driving growth and increasing your overall revenue.

Maximized Tax Savings:

Comprehensive Eligibility Check: WOTC.com analyzes your new hires against various WOTC criteria, ensuring you don’t miss out on any potential credits.

Automated Calculations: Eliminate manual calculations with automated WOTC credit value calculation tools.

Expert Claim Review: Our team of WOTC specialists meticulously reviews each claim to maximize your potential credit amount.

Benefits of Increased Revenue:

Reinvest in Growth: Use the tax savings generated from WOTC credits to invest in strategic initiatives like new equipment, marketing campaigns, or employee training.

Improved Cash Flow: Reduced tax liability translates to improved cash flow, providing more financial flexibility for your business.

Enhanced Profitability: WOTC.com’s assistance in maximizing tax credits directly contributes to your bottom line by increasing your overall profitability.